A few guidelines in case your future plans include living out your life in sunnier climes.

It’s a dream cherished by many Canadians nearing retirement who have managed to accumulate enough capital: starting a new life in another country to enjoy what appear to be more pleasant living conditions. It is estimated that about 10% of Canadians would like to retire to another country.

This is a major and multifaceted decision that should not be taken lightly. Among all the various considerations, taxes can single-handedly make the difference between living the dream… and living a nightmare. Here is an overview of some basic concepts. Note that for a more detailed understanding, the advice of a knowledgeable expert is heartily recommended.

First concept: residency

There are two ways of leaving Canada to live abroad: partially or completely. The first scenario is known to all “snowbirds.” These people spend enough time in Canada to retain their resident status. This means that they still benefit from our social programs and pay tax here on all their income, just like other Canadian citizens. It should be noted, however, that they may also have to pay tax in their adoptive country on income from non-Canadian sources. This might be the case, for instance, if they own property that generates rental income in the United States. As well, if they spend more than a certain number of days in the United States, they could be considered U.S. residents for tax purposes.

The second scenario is more radical. It consists of becoming a “non-resident.” Non-resident status is not simply based on the number of days spent in the country and must be recognized by the Canadian government. It implies that the person has broken their ties with Canada, which covers factors such as residence, the existence of a spouse, common-law partner or dependant in Canada, ownership of personal property or even ownership of credit cards and bank accounts.

Departure tax

From a taxation point of view, the first consequence of becoming a non-resident is something known as the deemed disposition of property. This means that you would be considered to have sold all of your unregistered assets at fair market value before leaving the country, which could result in a capital gain – and possibly a large tax bill.

Fortunately, there are many exceptions to this deemed disposition rule, including pension plans, annuities, registered retirement savings plans, group registered pension plans, registered retirement income funds, registered education savings plans, registered disability savings plans, tax-free savings accounts and several others.

Nonetheless, if you have substantial wealth held in unregistered investments, it might be a good idea to calculate this potentially heavy departure tax bill in advance.

Who taxes what?

As for the tax to be paid going forward, on an annual basis, the general rule that applies to non-residents is that their Canadian-source income – RRIF withdrawals, for example – is taxed in Canada and their income from everywhere other than Canada is taxed in their country of residence. Typically, Canadian financial institutions and some other payers will withhold tax of 25% on Canadian-source income that they pay or credit to a Canadian non-resident. However, if there is a tax treaty between Canada and the country of residence, it may include provisions that reduce the withholding tax rate on certain types of income.

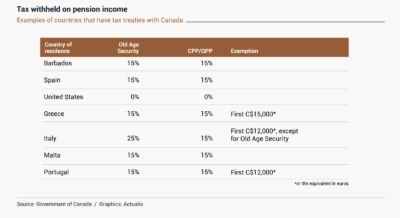

This is the case for Old Age Security and Canada or Quebec Pension Plan benefits. A withholding tax of 25% could be applied, but the treaties with many countries might reduce or even eliminate this tax. The following table provides a few examples to illustrate this.

In the end…

While many governments offer favourable tax treatment, especially to attract foreigners, this is not the case for all countries: as an ex-pat, you might actually end up with a higher tax burden than if you had remained a Canadian resident. As well, if the country hasn’t signed a tax treaty with Canada, you might find yourself being taxed twice.

When all is said and done, the tax situation for each taxpayer who has chosen to retire to another country is different and depends on both the composition of his or her assets and the choice of adoptive country. In some cases, the tax advantages could be appreciable. But still, breaking all ties with your country of origin is a major decision that affects every aspect of life. Although it’s essential to take a close, detailed look at the tax considerations, no one would generally recommend making this kind of decision based solely on the tax bill.

Back to myNiagaraOnline

Back to myNiagaraOnline