While life insurance is a relevant form of protection for a great number of people, it can be especially vital for a small business owner.

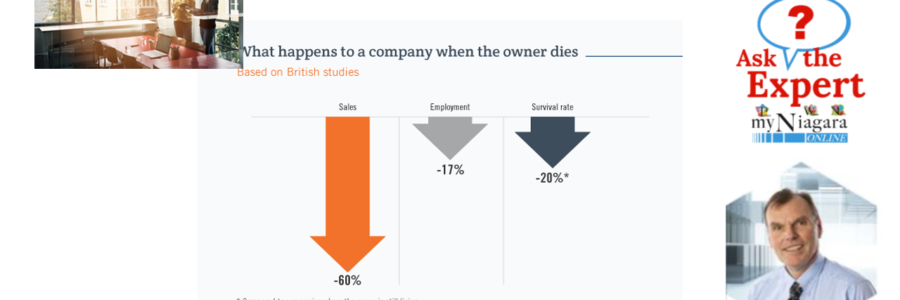

Canada is home to over 850,000 entrepreneurs, and the majority of them actually own small or medium-sized businesses. This situation raises the question of succession planning: would these SMEs be able to survive if the owner or one of the co-owners suddenly disappeared? As we can see from the following graphic, this is highly debatable.

These figures would seem to make a strong case in favour of life insurance for the business owner or partners. In fact, life insurance could satisfy at least seven strategic objectives.

Protect the company against losing a key person

A company’s success may sometimes be based on the presence of a few key people. One might be the founder or a partner, but another could be a key resource who does not necessarily have equity in the company: an outstanding VP of marketing, a brilliant designer, a computer expert who’s ahead of the curve, etc. If this person were to die unexpectedly, life insurance could offer the company a temporary financial cushion, providing enough time to find a new employee of the same calibre.

Ensure the survival of the company and the brand

In the event that the entrepreneur him- or herself were to die, the very survival of the company could be at stake. Some customers might worry about continued access to the products or services they receive. Creditors might also become nervous about the possibility of defaulted payments. In this case, life insurance could provide a source of cash to tide the company over while it implements the succession plan that would reassure both groups. Furthermore, if the death unfortunately led to company bankruptcy, it is good to know that an insurance policy, unlike other assets, generally can’t be seized by creditors.

Provide the estate with an exit strategy

Entrepreneurs usually have an exit strategy for themselves, which may include selling the business to a new group of investors so that the entrepreneur can go on to pursue other investments – or retirement. Life insurance could be seen as an exit strategy for the entrepreneur’s heirs should he or she die prematurely. By providing capital at death, life insurance could allow the business partners to buy back any shares left to the entrepreneur’s heirs.

Cover the tax bill

When an entrepreneur dies, just as for everyone else, he or she is deemed to have disposed of all assets and the estate must pay the associated taxes. These assets include the fair market value of the company, and a percentage of the capital gain on the company would be taxable. Life insurance could be used to pay this tax bill. Note that the deceased’s property may be “rolled over” tax free to a surviving spouse, but not to children.

Divide the bequest fairly among the heirs

It sometimes happens that the entrepreneur’s children are involved in the business – but not necessarily all of the children. The capital provided by life insurance could help to balance the estate between the children who are interested in taking the business farther and those who are not.

Obtain financing

From a more immediately operational standpoint, life insurance could also help an entrepreneur to obtain the financing needed for business development by providing creditors with a guarantee that they would be repaid in the event of the entrepreneur’s death.

A tax-efficient solution

Last but not least, remember that the benefits paid by a life insurance policy are not taxable. Along with the need for protection summarized above, this status paves the way for certain investment strategies, especially if the entrepreneur has additional capital to invest after having maxed out registered vehicles such as the RRSP, TFSA and RESP.

For more information about life insurance strategies tailored to the needs of entrepreneurs, talk to your mutual fund representative or financial services professional.

The following sources were used to prepare this article:

Business News Daily, “When Founders Die, Businesses Suffer”.

Canadian Life and Health Insurance Association, “A Guide to Life Insurance”.

Conseiller, “4 raisons de recommander une assurance vie”.

Entrepreneurship in a Box, “7 Crucial Reasons Why You Need Life Insurance as an Entrepreneur”.

Fabric, “What Entrepreneurs Need to Know About Life Insurance”.

Forbes, “Many Firms Don’t Survive After Owners Die”.

InfoPrimes, “Les avantages d’une assurance vie pour un entrepreneur”.

Profitable Venture, “13+ Reasons Why Entrepreneurs Need Life Insurance Policy”.

Back to myNiagaraOnline

Back to myNiagaraOnline