On Tuesday November 3rd, 2020, U.S. citizens will be electing their next president. What influence could an event like that have on the stock market? Here’s what history has to say about it.

A lot of things are at stake in the lead-up to the United States elections on November 3. One of these might well be the behaviour of the stock market, behaviour that could send ripples directly into the investment portfolios of millions of people. In this article: a few considerations about this topic, based on observations from past elections.

Question 1

What do elections say about the markets?

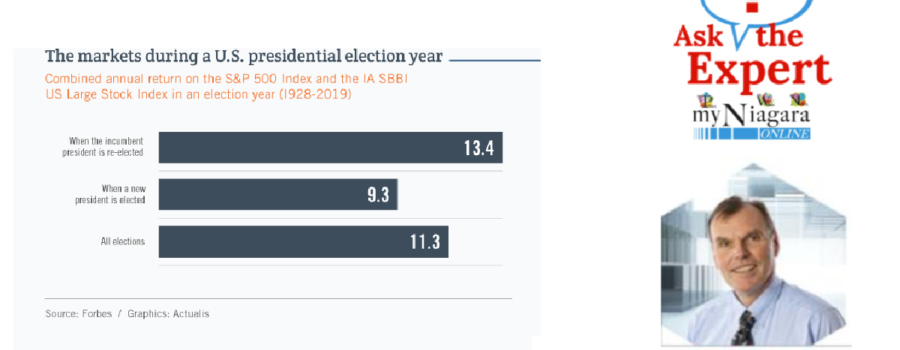

As we can see in the graph below, during election years the financial markets have tended to perform better when the incumbent president is re-elected than when a new president comes into office. This trend seems to hold regardless of political party and reflects the market’s preference for the “known” rather than the unknown. However, one might keep in mind that today’s socio-health context is unprecedented from several points of view and could have an impact on market performance no matter which way the election goes.

For guidance, the average annual return on the stock market for the year after an election – 9.9% – would be slightly below that of the election year itself – 11.3%. Another detail: in the four months following an election, the markets would provide higher returns under a Republican president, but this trend would reverse itself in subsequent months: in fact, Democratic presidents would outdo Republican presidents by at least 7% for the first year as a whole. Finally, note that the best stock market returns in the past 40 years would occur under Democratic presidents (Clinton and Obama).

Question 2

What do the markets say about upcoming elections?

If we turn the telescope around, is it possible to anticipate election results by looking at how the markets are behaving? Some analysts have ventured to do so by studying past elections to see how they correlate with the performance of the S&P 500 Index in the three preceding months. Conclusion: since 1928, with the exception of only three elections, the party in power was re-elected when the index was in positive territory and was beaten when the index was in negative territory. For reference, at the time of this writing, the S&P 500 was up slightly for the last three months.

Question 3

Do the markets prefer a Democratic president or a Republican president?

Contrary to what electoral platforms and speeches might seem to imply, the markets would show their best returns under Democratic presidents. Since the end of World War II, the average annual return on the S&P 500 Index would be more than 4% higher under Democratic presidents than Republican presidents. It should be noted, however, that in the short run the market return at the end of the first term would be virtually identical, on average, under Democratic and Republican presidents.

That said, it could be quite chancy to try “timing” one’s investment decisions based on the president in office. As shown by the graph below, during the 20th century, it would have been much better to remain invested at all times.

Question 4

What about the division of powers?

Of course, many factors other than the president in office could account for market behaviour. One factor that rarely comes up is the composition of the two chambers of the U.S. Congress: the House of Representatives and the Senate. Here the markets seem to have a clear preference: they like it when the legislative power of Congress and the executive power of the president are not entirely in the hands of the same party, which precludes the adoption of measures that may be too radical.

As we can see here, the best returns under Democratic presidents occurred when Congress was Republican – and under Republican presidents when Congress was divided. This might be an incentive to pay special attention to the senatorial component of the elections on November 3.

In conclusion, what can be expected from the markets going forward? The answer would more likely be revealed in 12 – or even 48 – months than on November 3.

The following sources were used to prepare this article:

Advisor Analyst, “Election Blues: Looking at Election History for Market Guidance”.

CNN, “Stocks perform better when a Democrat is in the White House. History proves it”.

Darrow Wealth Management, “Stock Market Performance by President (in Charts)”.

Forbes, “Here’s How The Stock Market Has Performed Before, During, And After Presidential Elections” ; “We Looked At How The Stock Market Performed Under Every U.S. President Since Truman — And The Results Will Surprise You”.

Investopedia, “Where Was the Dow Jones When Obama Took Office?”.

Market Watch, “S&P 500 Index”.

Schroders, “Would a Biden presidency hurt stock prices?”.

The Balance, “Timing the Market With the 2020 Presidential Election”.

USA Today, “Can the stock market predict whether Joe Biden will be the next president or Donald Trump wins a second term?”.

Back to myNiagaraOnline

Back to myNiagaraOnline