You don’t always need to take more risks in order to increase the capital available to you in 10, 20 or 30 years. Here’s a brief look at three approaches with more potential than you might think.

While every season is the right season to contribute, Canadians often refer to the first two months of the year as “RRSP season.” This is because Canadian taxpayers have the first 60 days of the year to complete their RRSP contributions for the previous taxation year, which, in particular, allows them to deduct this amount on their income tax returns a few weeks later.

However, this annual tradition raises one question: do the timing and frequency of RRSP contributions have an impact on capital growth? This article gives an overview of three strategies demonstrating that, yes, it is possible to boost your retirement capital simply by changing your habits, without actually setting aside more savings and without increasing the risk level of your portfolio.

Note that the following examples are based on the assumption that all other factors influencing capital growth, including the return on investment, remain equal.

Strategy 1

Contribute at the start of the year

If you make your contribution in a single payment once a year, it could be important to do so at the start of the year. The reason, quite simply, is that time is one of the most important factors in the growth of an RRSP. Each additional year of tax-sheltered compound growth can make a significant difference, since each year’s return “compounds” the return from the previous one. Contributing early means providing additional time for this compound growth dynamic to work.

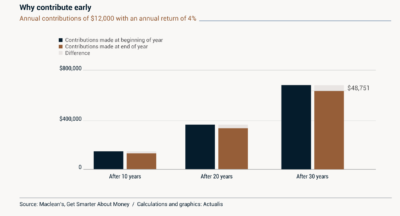

As we can see in the following graph, an annual contribution of $12,000 made at the start rather than the end of the year, assuming an annual return of 4%, could represent a difference of almost $49,000 after 30 years. And if you wait five years longer? The gain, in that case, would be $62,000. It’s like getting five extra years of RRSP contributions without having put in any extra money.

Strategy 2

Contribute regularly

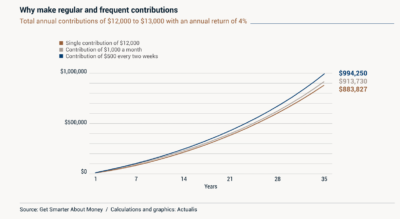

The same logic dictates that contributing throughout the year should produce a better long-term result than single contributions made at the end of the year. The graph below, which also illustrates the third strategy, shows that this is true. Compared to a single $12,000 contribution made at the end of the year, monthly contributions of $1,000 could result in a gain of around $30,000, 35 years later. Once again, this wouldn’t require a single cent more, just a change in saving habits.

Along with the fact that it might be easier to contribute smaller amounts on a monthly basis, this contribution method, known as dollar cost averaging, has another advantage: the portfolio is built up through purchases at different phases of the market cycle, resulting in an average price that is neither the highest nor the lowest, and could mitigate the effect of market volatility on the portfolio.

Strategy 3

Contribute often

The third strategy simply pushes this logic a little farther by making contributions of $500 every two weeks (every payday, for example), instead of monthly payments. This simple change of frequency produces two effects. First, the total annual contribution increases, almost imperceptibly, by $1,000 per year (26 x $500 = $13,000). Second, it allows the retirement capital grow to almost a million dollars over 35 years – more than $100,000 higher than with once-yearly payments.

Obviously, these hypothetical calculations assume that the contributions are immediately invested (in a diversified portfolio of mutual funds, for example) and that the return is constant over time – which is never the case. Nonetheless, they demonstrate that some simple changes in saving habits can result in appreciable gains over a long period.

Back to myNiagaraOnline

Back to myNiagaraOnline