How to use your retirement savings for more immediate plans.

Two ways of “borrowing” from an RRSP

It is possible to make fully tax-free withdrawals from an RRSP as long as these are used to fund two specific types of projects: either to buy a first home or to go back to school full time. In the first case, the money is withdrawn under the Home Buyers’ Plan (HBP), and in the second, under the Lifelong Learning Plan (LLP).

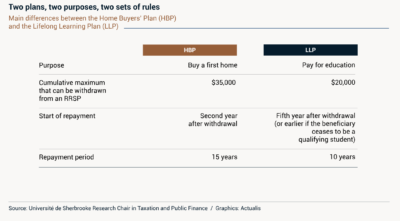

These two plans have some similarities: you take money out of your RRSP without paying withholding tax, then have a certain number of years to “repay” the RRSP. It’s rather like making an interest-free loan to yourself out of your own RRSP. However, the two plans have different conditions, as summarized in the table below.

Home Buyers’ Plan (HBP)

The HBP allows you to withdraw up to $35,000 from your RRSP to make a down payment on a first residential property. A couple who are both eligible for the HBP could thus have a total down payment of $70,000, which could theoretically allow them to consider a property worth up to $950,000 – providing, of course, that they meet the other criteria for getting a mortgage.

You would then have 15 years, as of the second year following the withdrawal, to repay your RRSP at 1/15 of the total amount per year. To do this, once you made your annual RRSP contribution you would simply indicate how much should be applied to the HBP repayment. There is nothing to prevent you from repaying more than the required minimum in a given year. In that case, the annual repayment amounts for subsequent years would be recalculated by the government. On the other hand, if you should fail to meet the required annual minimum repayment, that amount would be added to your taxable income for the next year.

Note that, under some circumstances, someone who has already owned property in the past might still qualify for the HBP, especially in the case of a recent separation.

This Government of Canada website provides all the details about the HBP terms and conditions.

Lifelong Learning Plan (LLP)

The LLP, on the other hand, allows someone who is going back to school on a full-time basis to borrow up to $10,000 per year from their RRSP for this purpose, to a maximum of $20,000 in total. You may withdraw the amount of your choice each year, but after making the first withdrawal you must make all the rest within five years.

It is interesting to note that these withdrawals can be applied to a return to school for either the contributor or the contributor’s spouse. This means that a couple could access $40,000 to finance an educational leave for one of them if both had $20,000 in their RRSPs. As well, once the money is withdrawn, no documentation of expenses is required, which means that the money does not necessarily have to be used specifically for tuition fees.

For the LLP, the repayment period is 10 years at 1/10 of the borrowed amount per year. Repayment begins as of the fifth year following the initial withdrawal, or earlier if the person ceases to be an eligible student. If repayments are higher or lower than the required minimum, the same terms apply as for the HBP.

For details, visit this Government of Canada website.

Also available for other needs, but…

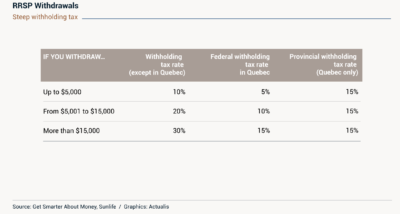

As well, given that 2020 was financially difficult for many Canadians, it could be important to know that RRSP withdrawals can also be made at any time to deal with an unforeseen crisis. In this case, however, the tax provisions associated with the HBP and the LLP are not available: withdrawals will be considered as taxable income, in addition to being subject to an immediate withholding tax of as much as 30%. The following table summarizes the rules that apply. Generally speaking, this option would only be recommended as a last resort.

HBPs and LLPs are available from the same financial institutions that offer RRSPs. Don’t hesitate to discuss this topic with your mutual fund representative or financial services professional.

Back to myNiagaraOnline

Back to myNiagaraOnline