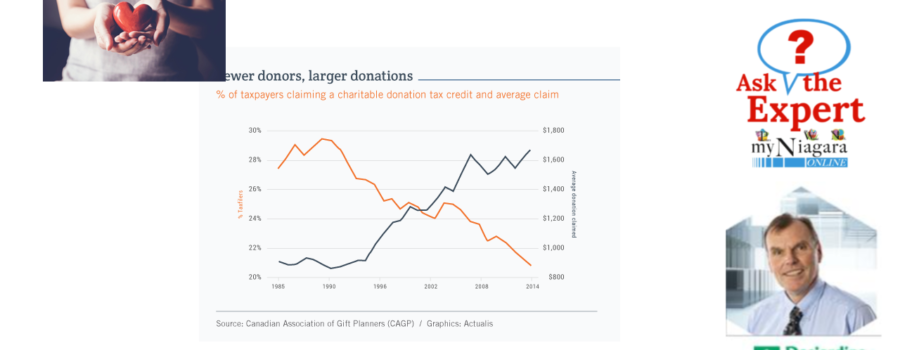

Based on figures from the Canadian Association of Gift Planners (CAGP), most high net worth individuals give donations of under $10,000, i.e., less than 1% of their assets.

If you yourself have a certain amount of wealth and would like to do more for the causes that are important to you, planned giving could be a way for you to play an effective role.

What is a planned giving strategy?

The CAGP defines a planned giving strategy as an approach aimed at optimizing the benefits of giving for both the donor and the charitable organization. Planned gifts can be immediate or deferred, allowing donors to fulfil their philanthropic wishes within the context of their personal, family and tax considerations.

Tax credits

In setting up this kind of strategy, it could be essential to consult a tax specialist, because taking numerous tax provisions into account can be of key importance. The first of these provisions is a group of tax credits offered by both levels of government. At the federal level, there is a tax credit of 15% for amounts up to $200 and 29% of any amount in excess of that, subject to certain conditions. Tax credits can also be claimed at the provincial level. Depending on the province, the total tax savings provided by a donation could be in the range of 40% to 50%. Note that additional tax credits may also apply – for significant cultural donations in Quebec, for example. Keep in mind, however, that, as a rule, at the federal level there is a cap of 75% of the taxpayer’s net income on cash donations for which credits can be claimed in a given year. On the other hand, the tax credits not claimed in the year the donation was made can be carried forward for up to five years. Once again, the advice of a tax specialist could be invaluable, since there are many different scenarios that could lend themselves to specific situations.

Now let’s look at the three factors for managing a planned giving strategy.

Planning for the right time to give

According to the CAGP, less than one-quarter of high net worth individuals include philanthropic instructions in their wills. However, is it usually when someone passes away that significant assets are freed up, notably from a life insurance policy or the disposition of an RRSP or RRIF. A plan could take into account the individual’s personal, family and tax considerations to determine the best times to make donations and to claim the associated tax credits (which may not be the same). A plan can also incorporate different measures such as naming a charitable organization as the beneficiary of an RRSP or RRIF, or creating a testamentary or charitable remainder trust.

Planning for the right type of gift

The tax treatment of a donation may vary depending on what form the donation takes. For example, when certain investment securities (such as mutual fund units*) are donated, the capital gain on the investments might not be taxable. By comparison, if the donor were to sell the securities first in order to make a cash donation, there would be tax to pay on half of the capital gain. Similarly, if the donor’s holding company were to make the donation, it could increase its capital dividend account and allow for the payment of tax-free dividends.

A donation in the form of life insurance could also be effective, notably because it could provide a larger sum for the organization than if the donor had directly donated an amount equal to the premiums instead.

Planning for the right donation vector

Finally, it is important to know that a donation can be made to a charitable organization, a private foundation or a public foundation. These last two make it possible to plan philanthropic activity through an organization that itself makes donations to various other organizations. Large donors will often set up their own private foundations. A public foundation, on the other hand, allows management to be delegated to a collective team. Both could be interesting options, especially for an entrepreneur who has just sold a business and will suddenly have a large chunk of capital to redirect to favourite causes.

A question of values

As we can see, a planned giving strategy can make a difference for the receiving organizations, and also for donors and their estates. If your net worth allows you to contemplate this approach, a first step might be to talk to your financial security advisor or mutual fund representative, as well as your tax specialist.

* Mutual Funds are offered through Desjardins Financial Security Investments Inc.

The following sources were used to prepare this article:

Actualis, “Philanthropy: an important part of an integrated financial plan”.

CAGP, GIV3, PfC and BMO, “The Philanthropic Conversation”.

CalculConversion, “Calculateur de don 2020”.

Centraide, “Keeping people fed during the crisis” ; “Le don planifié : un geste de raison… une affaire de cœur !”.

Fondation Rideau Hall et Imagine Canada, “30 years of giving in Canada”.

Université de Sherbrooke, Chaire en fiscalité et finances publiques, “Crédit d’impôt pour dons”.